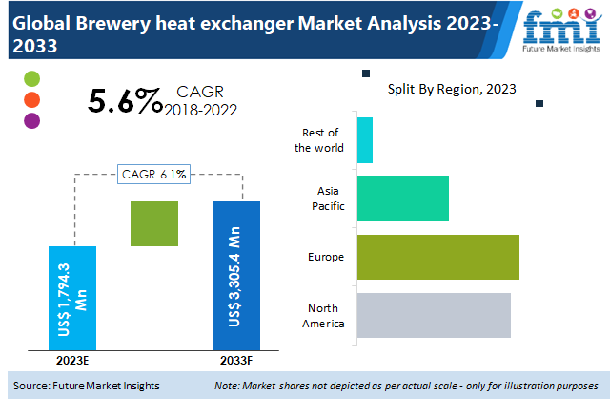

According to Future Market Insights, the brewery heat exchanger market size is anticipated to grow at a CAGR of 6.1% during the forecasted period. According to Analysts, the market is likely to be worth US$ 3,305.4 million by 2033, up from US$ 1,794.3 million in 2023. Some major growth propellers of the market include:

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Unique designs are used by brewery heat exchanger manufacturers to increase efficiency and suit the processing demands of varied commodities with different viscosities. For instance, plate heat exchanger technology is essential in applications for dairy, beverages, and processed foods. Thus, the demand for brewery heat exchangers is anticipated to rise over the forecast period. A significant market potential for plate & frame exchangers is being created by the rising need for energy-efficient heat exchange systems.

The global brewery heat exchanger market has undergone significant transformation in recent years. The most common and widely used heat recovery equipment is brewery heat exchangers. To meet long-term sustainability goals, regulatory agencies are working to minimize energy consumption, which is driving the global market for brewery heat exchangers. In many countries, the usage of brewery heat exchangers has significantly expanded in recent years.

The brewery heat exchanger market is expected to grow significantly in the coming years. This is due to the increasing demand for beer and other alcoholic beverages. The heat exchanger is an essential piece of equipment in a brewery, as it helps to keep the beer at a consistent temperature. There are a variety of different types of brewery heat exchangers available on the market, and each has its advantages and disadvantages. It is important to choose the right type of heat exchanger for your brewery, as this will affect the quality of your beer.

| Attribute | Details |

|---|---|

| Brewery Heat Exchanger Market Estimated Size (2023) | US$ 1,794.3 million |

| Brewery Heat Exchanger Market Forecast Size (2033) | US$ 3,305.4 million |

| Brewery Heat Exchanger Market (CAGR) | 6.1% |

| Share of Germany in Brewery Heat Exchanger Market | 23.8% |

According to Future Market Insights, the brewery heat exchanger market was growing at a CAGR of 4.2% to reach US$ 1,379.8 million in 2022 from US$ 1,170.4 million in 2018.

The market is driven by various factors such as the increasing demand for beer and other alcoholic beverages and the need for efficient cooling solutions in breweries. The rising popularity of craft beer and the increasing number of microbreweries are also driving the growth of the brewery heat exchanger market. However, the high cost of installation and maintenance is restraining the growth of this market.

The food and beverage industry is one of the major industries propelling the sales of the brewery heat exchanger. Heat exchangers are used to transfer heat from one fluid to another, and are an essential component in many food and beverage processing applications. The use of heat exchangers can help breweries save energy and improve product quality. The food and beverage industry is a major user of heat exchangers. The brewing process itself relies on heat exchangers to transfer heat from the hot wort to the cooling water. Heat exchangers are also used in other parts of the brewing process, such as during fermentation and pasteurization.

To maintain high levels of productivity, breweries need to have reliable heat exchangers. The beer and wort applications are expected to see the greatest growth in the brewery heat exchangers market. This is due to the increasing demand for craft beer and the need for efficient brewing processes.

The beer and wort applications are expected to see the greatest growth in the brewery heat exchangers market. This is due to the increasing demand for craft beer and the need for efficient brewing processes. The use of heat exchangers helps breweries save time and energy by efficiently heating or cooling liquids.

There are a variety of different types of heat exchangers available on the market, each with its benefits. Plate heat exchangers are often used in breweries because they provide a high level of thermal efficiency.

United States' dominance in the market is due to several factors. First, there is a large and well-established brewing industry in North America. This provides a ready market for heat exchangers and other brewing equipment. Second, brewery heat exchanger manufacturers have been able to capitalize on this demand by developing innovative and efficient heat exchangers. This has allowed them to gain a significant share of the global market. Finally, North American brewers have also been able to benefit from economies of scale, which have helped to lower costs and improve competitiveness.

Germany currently maintains the greatest share of the European brewery heat exchangers market, owing to the region's export-based nature and substantial installed brewery heat exchanger plant capacity. Furthermore, it is home to the majority of the market's major companies.

The European market is a very attractive market for brewery heat exchangers due to its large size and potential for growth. The market is also appealing due to its regulatory environment, which is much more favorable to the brewing industry than other markets such as the United States. Finally, Europe has a long history of brewing and a strong culture of beer consumption, making it an ideal place to sell brewery heat exchangers.

China is expected to be the fastest-growing market for brewery heat exchangers during the forecast period. The demand for beer in the China and India is growing at a rapid pace, owing to the changing lifestyles of people and the increasing disposable incomes. In addition, the rising number of bars and pubs in the region is also driving the growth of the brewery heat exchangers market. Moreover, the presence of a large number of small and medium-sized breweries in the region is providing a boost to market growth.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need

and save 40%!

The number of players in the market has increased significantly, and the level of competition has also intensified. In addition, the players are also investing heavily in research and development to gain a competitive edge over their rivals.

The major approach used by market participants to improve their market position was new product releases. Expansions, mergers and acquisitions, and contracts, agreements, and partnerships are some of the other tactics employed by manufacturers to capture a larger share of the market.

Alfa Laval, a Swedish firm, to Lead in Terms of Manufacturing Brewery Heat Exchanger Equipment

Over the next several years, the firm will primarily focus on Research and Development (R&D) to create new goods and services, as well as build highly efficient heat exchangers. It also produces high-quality items, which contributes to the company's excellent brand image in this industry. Alfa Laval introduced a new product for cooling data centers, which is another area that is predicted to develop rapidly shortly.

Alfa Laval AB is committed to optimizing processes, supporting sustainable growth and development, and moving ahead - always going above and beyond to help clients accomplish their business goals and sustainability goals. Alfa Laval has a workforce of 17,500 individuals. In 2019, revenues amounted to SEK 46.5 million (about EUR 4.4 million). The stock is listed on the Nasdaq OMX platform.

The Company's product portfolio of plate & frame heat exchangers includes the following:

Some of the Major Players in the Market for Brewery Heat Exchangers

| Attribute | Details |

|---|---|

| Forecast period | 2023 to 2033 |

| Historical data available for | 2018 to 2022 |

| Market analysis | US$ million in value |

| Key regions covered |

|

| Key countries covered |

|

| Key segments covered |

|

| Key companies profiled |

|

| Report Coverage |

|

| Customization and Pricing |

|

The brewery heat exchanger market size is assessed to be US$ 1,794.3 million in 2023.

The brewery heat exchanger market is expected to rise at a CAGR of 6.1% during the forecast period.

China's brewery heat exchanger market is projected to grow at a CAGR of around 5.8% over the next ten years.

Germany holds approximately 23.8% brewery heat exchanger market.

The global brewery heat exchanger market is forecasted to surpass US$ 3,305.4 million by the end of 2033.

1. Executive Summary | Brewery Heat Exchanger Market

1.1. Global Market Outlook

1.2. Demand-side Trends

1.3. Supply-side Trends

1.4. Technology Roadmap Analysis

1.5. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage / Taxonomy

2.2. Market Definition / Scope / Limitations

3. Market Background

3.1. Market Dynamics

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunity

3.1.4. Trends

3.2. Scenario Forecast

3.2.1. Demand in Optimistic Scenario

3.2.2. Demand in Likely Scenario

3.2.3. Demand in Conservative Scenario

3.3. Product launches & Recent Developments

3.4. Product Life Cycle Analysis

3.5. Value Chain Analysis

3.5.1. Supply Side Participants and their Roles

3.5.1.1. Producers

3.5.1.2. Mid-Level Participants (Traders/ Agents/ Brokers)

3.5.1.3. Wholesalers and Distributors

3.5.2. % of Operating Margin Analysis

3.5.3. List of Raw Material Suppliers

3.5.4. List of Existing and Potential Buyers

3.6. Global Market - Pricing Analysis

3.6.1. Price Point Assessment by Region

3.6.2. Price Point Assessment by Product Type

3.6.3. Price Forecast till 2033

3.6.4. Factors affecting pricing

3.7. Forecast Factors - Relevance & Impact

3.8. PESTLE and Porter’s Analysis

3.9. Regulatory Landscape

3.9.1. Packaging & Labelling Regulations

3.9.2. Certifications and Certifying Agency Overview

3.9.3. Import/Export Policies

3.10. Regional Parent Market Outlook

3.11. Production and Consumption Statistics

3.12. Import and Export Statistics

3.13. Consumers Survey Analysis

3.14. Macro-Economic Factors

3.15. Product Claims & Nutritional Information scanned by Buyers

4. Global Analysis 2018 to 2022 and Forecast, 2023 to 2033

4.1. Historical Market Size Value (US$ million) & Volume (MT) Analysis, 2018 to 2022

4.2. Current and Future Market Size Value (US$ million) & Volume (MT) Projections, 2023 to 2033

4.2.1. Y-o-Y Growth Trend Analysis

4.2.2. Absolute $ Opportunity Analysis

5. Global Analysis 2018 to 2022 and Forecast 2023 to 2033, By Type

5.1. Introduction / Key Findings

5.2. Historical Market Size Value (US$ million) & Volume (MT) Analysis By Type, 2018 to 2022

5.3. Current and Future Market Size Value (US$ million) & Volume (MT) Analysis and Forecast By Type, 2023 to 2033

5.3.1. Plate and frame

5.3.2. Shell and tube

5.3.3. Spiral wound

5.3.4. Immersion coil

5.4. Y-o-Y Growth Trend Analysis By Type, 2018 to 2022

5.5. Absolute $ Opportunity Analysis By Type, 2023 to 2033

6. Global Analysis 2018 to 2022 and Forecast 2023 to 2033, By Application

6.1. Introduction / Key Findings

6.2. Historical Market Size Value (US$ million) & Volume (MT) Analysis By Application, 2018 to 2022

6.3. Current and Future Market Size Value (US$ million) & Volume (MT) Analysis and Forecast By Application, 2023 to 2033

6.3.1. Beer

6.3.2. Cooling

6.3.3. Wort Heating

6.4. Y-o-Y Growth Trend Analysis By Application, 2018 to 2022

6.5. Absolute $ Opportunity Analysis By Application, 2023 to 2033

7. Global Analysis 2018 to 2022 and Forecast 2023 to 2033, By Region

7.1. Introduction

7.2. Historical Market Size Value (US$ million) & Volume (MT) Analysis By Region, 2018 to 2022

7.3. Current Market Size Value (US$ million) & Volume (MT) Analysis and Forecast By Region, 2023 to 2033

7.3.1. North America

7.3.2. Latin America

7.3.3. Europe

7.3.4. East Asia

7.3.5. South Asia

7.3.6. Oceania

7.3.7. Middle East and Africa (MEA)

7.4. Market Attractiveness Analysis By Region

8. North America Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

8.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

8.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

8.2.1. By Country

8.2.1.1. The USA

8.2.1.2. Canada

8.2.2. By Type

8.2.3. By Application

8.3. Market Attractiveness Analysis

8.3.1. By Country

8.3.2. By Type

8.3.3. By Application

8.4. Key Takeaways

9. Latin America Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

9.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

9.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

9.2.1. By Country

9.2.1.1. Brazil

9.2.1.2. Mexico

9.2.1.3. Argentina

9.2.1.4. Chile

9.2.1.5. Peru

9.2.1.6. Rest of Latin America

9.2.2. By Type

9.2.3. By Application

9.3. Market Attractiveness Analysis

9.3.1. By Country

9.3.2. By Type

9.3.3. By Application

9.4. Key Takeaways

10. Europe Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

10.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

10.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

10.2.1. By Country

10.2.1.1. Germany

10.2.1.2. Italy

10.2.1.3. France

10.2.1.4. United Kingdom

10.2.1.5. Spain

10.2.1.6. Russia

10.2.1.7. BENELUX

10.2.1.8. Poland

10.2.1.9. Nordic Countries

10.2.1.10. Rest of Europe

10.2.2. By Type

10.2.3. By Application

10.3. Market Attractiveness Analysis

10.3.1. By Country

10.3.2. By Type

10.3.3. By Application

10.4. Key Takeaways

11. East Asia Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

11.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

11.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

11.2.1. By Country

11.2.1.1. China

11.2.1.2. Japan

11.2.1.3. South Korea

11.2.2. By Type

11.2.3. By Application

11.3. Market Attractiveness Analysis

11.3.1. By Country

11.3.2. By Type

11.3.3. By Application

11.4. Key Takeaways

12. South Asia Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

12.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

12.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

12.2.1. By Country

12.2.1.1. India

12.2.1.2. Thailand

12.2.1.3. Malaysia

12.2.1.4. Indonesia

12.2.1.5. Singapore

12.2.1.6. Rest of South Asia

12.2.2. By Type

12.2.3. By Application

12.3. Market Attractiveness Analysis

12.3.1. By Country

12.3.2. By Type

12.3.3. By Application

12.4. Key Takeaways

13. Oceania Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

13.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

13.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

13.2.1. By Country

13.2.1.1. Australia

13.2.1.2. New Zealand

13.2.2. By Type

13.2.3. By Application

13.3. Market Attractiveness Analysis

13.3.1. By Country

13.3.2. By Type

13.3.3. By Application

13.4. Key Takeaways

14. MEA Analysis 2018 to 2022 and Forecast 2023 to 2033, By Country

14.1. Historical Market Size Value (US$ million) & Volume (MT) Trend Analysis By Market Taxonomy, 2018 to 2022

14.2. Market Size Value (US$ million) & Volume (MT) Forecast By Market Taxonomy, 2023 to 2033

14.2.1. By Country

14.2.1.1. GCC Countries

14.2.1.2. South Africa

14.2.1.3. Central Africa

14.2.1.4. North Africa

14.2.2. By Type

14.2.3. By Application

14.3. Market Attractiveness Analysis

14.3.1. By Country

14.3.2. By Type

14.3.3. By Application

14.4. Key Takeaways

15. Key Countries Analysis

15.1. The USA

15.1.1. Pricing Analysis

15.1.2. Market Share Analysis, 2022

15.1.2.1. By Type

15.1.2.2. By Application

15.2. Canada

15.2.1. Pricing Analysis

15.2.2. Market Share Analysis, 2022

15.2.2.1. By Type

15.2.2.2. By Application

15.3. Brazil

15.3.1. Pricing Analysis

15.3.2. Market Share Analysis, 2022

15.3.2.1. By Type

15.3.2.2. By Application

15.4. Mexico

15.4.1. Pricing Analysis

15.4.2. Market Share Analysis, 2022

15.4.2.1. By Type

15.4.2.2. By Application

15.5. Argentina

15.5.1. Pricing Analysis

15.5.2. Market Share Analysis, 2022

15.5.2.1. By Type

15.5.2.2. By Application

15.6. Chile

15.6.1. Pricing Analysis

15.6.2. Market Share Analysis, 2022

15.6.2.1. By Type

15.6.2.2. By Application

15.7. Peru

15.7.1. Pricing Analysis

15.7.2. Market Share Analysis, 2022

15.7.2.1. By Type

15.7.2.2. By Application

15.8. Germany

15.8.1. Pricing Analysis

15.8.2. Market Share Analysis, 2022

15.8.2.1. By Type

15.8.2.2. By Application

15.9. Italy

15.9.1. Pricing Analysis

15.9.2. Market Share Analysis, 2022

15.9.2.1. By Type

15.9.2.2. By Application

15.10. France

15.10.1. Pricing Analysis

15.10.2. Market Share Analysis, 2022

15.10.2.1. By Type

15.10.2.2. By Application

15.11. Spain

15.11.1. Pricing Analysis

15.11.2. Market Share Analysis, 2022

15.11.2.1. By Type

15.11.2.2. By Application

15.12. The United Kingdom

15.12.1. Pricing Analysis

15.12.2. Market Share Analysis, 2022

15.12.2.1. By Type

15.12.2.2. By Application

15.13. Russia

15.13.1. Pricing Analysis

15.13.2. Market Share Analysis, 2022

15.13.2.1. By Type

15.13.2.2. By Application

15.14. Poland

15.14.1. Pricing Analysis

15.14.2. Market Share Analysis, 2022

15.14.2.1. By Type

15.14.2.2. By Application

15.15. BENELUX

15.15.1. Pricing Analysis

15.15.2. Market Share Analysis, 2022

15.15.2.1. By Type

15.15.2.2. By Application

15.16. Nordic Countries

15.16.1. Pricing Analysis

15.16.2. Market Share Analysis, 2022

15.16.2.1. By Type

15.16.2.2. By Application

15.17. China

15.17.1. Pricing Analysis

15.17.2. Market Share Analysis, 2022

15.17.2.1. By Type

15.17.2.2. By Application

15.18. Japan

15.18.1. Pricing Analysis

15.18.2. Market Share Analysis, 2022

15.18.2.1. By Type

15.18.2.2. By Application

15.19. South Korea

15.19.1. Pricing Analysis

15.19.2. Market Share Analysis, 2022

15.19.2.1. By Type

15.19.2.2. By Application

15.20. India

15.20.1. Pricing Analysis

15.20.2. Market Share Analysis, 2022

15.20.2.1. By Type

15.20.2.2. By Application

15.21. Thailand

15.21.1. Pricing Analysis

15.21.2. Market Share Analysis, 2022

15.21.2.1. By Type

15.21.2.2. By Application

15.22. Indonesia

15.22.1. Pricing Analysis

15.22.2. Market Share Analysis, 2022

15.22.2.1. By Type

15.22.2.2. By Application

15.23. Malaysia

15.23.1. Pricing Analysis

15.23.2. Market Share Analysis, 2022

15.23.2.1. By Type

15.23.2.2. By Application

15.24. Singapore

15.24.1. Pricing Analysis

15.24.2. Market Share Analysis, 2022

15.24.2.1. By Type

15.24.2.2. By Application

15.25. Australia

15.25.1. Pricing Analysis

15.25.2. Market Share Analysis, 2022

15.25.2.1. By Type

15.25.2.2. By Application

15.26. New Zealand

15.26.1. Pricing Analysis

15.26.2. Market Share Analysis, 2022

15.26.2.1. By Type

15.26.2.2. By Application

15.27. GCC Countries

15.27.1. Pricing Analysis

15.27.2. Market Share Analysis, 2022

15.27.2.1. By Type

15.27.2.2. By Application

15.28. South Africa

15.28.1. Pricing Analysis

15.28.2. Market Share Analysis, 2022

15.28.2.1. By Type

15.28.2.2. By Application

15.29. North Africa

15.29.1. Pricing Analysis

15.29.2. Market Share Analysis, 2022

15.29.2.1. By Type

15.29.2.2. By Application

15.30. Central Africa

15.30.1. Pricing Analysis

15.30.2. Market Share Analysis, 2022

15.30.2.1. By Type

15.30.2.2. By Application

16. Market Structure Analysis

16.1. Competition Dashboard

16.2. Competition Benchmarking

16.3. Market Share Analysis of Top Players

16.3.1. By Regional

16.3.2. By Type

16.3.3. By Application

17. Competition Analysis

17.1. Competition Deep Dive

17.1.1. GEA Group

17.1.1.1. Overview

17.1.1.2. Product Portfolio

17.1.1.3. Profitability by Market Segments (Type /Application/Region)

17.1.1.4. Sales Footprint

17.1.1.5. Strategy Overview

17.1.1.5.1. Marketing Strategy

17.1.1.5.2. Product Strategy

17.1.1.5.3. Channel Strategy

17.1.2. Aktiengesellschaft

17.1.2.1. Overview

17.1.2.2. Product Portfolio

17.1.2.3. Profitability by Market Segments (Type /Application/Region)

17.1.2.4. Sales Footprint

17.1.2.5. Strategy Overview

17.1.2.5.1. Marketing Strategy

17.1.2.5.2. Product Strategy

17.1.2.5.3. Channel Strategy

17.1.3. Alfa Laval AB

17.1.3.1. Overview

17.1.3.2. Product Portfolio

17.1.3.3. Profitability by Market Segments (Type /Application/Region)

17.1.3.4. Sales Footprint

17.1.3.5. Strategy Overview

17.1.3.5.1. Marketing Strategy

17.1.3.5.2. Product Strategy

17.1.3.5.3. Channel Strategy

17.1.4. Koch Engineered Solutions

17.1.4.1. Overview

17.1.4.2. Product Portfolio

17.1.4.3. Profitability by Market Segments (Type /Application/Region)

17.1.4.4. Sales Footprint

17.1.4.5. Strategy Overview

17.1.4.5.1. Marketing Strategy

17.1.4.5.2. Product Strategy

17.1.4.5.3. Channel Strategy

17.1.5. Swenson Technology

17.1.5.1. Overview

17.1.5.2. Product Portfolio

17.1.5.3. Profitability by Market Segments (Type /Application/Region)

17.1.5.4. Sales Footprint

17.1.5.5. Strategy Overview

17.1.5.5.1. Marketing Strategy

17.1.5.5.2. Product Strategy

17.1.5.5.3. Channel Strategy

17.1.6. Praj Industries Ltd.

17.1.6.1. Overview

17.1.6.2. Product Portfolio

17.1.6.3. Profitability by Market Segments (Type /Application/Region)

17.1.6.4. Sales Footprint

17.1.6.5. Strategy Overview

17.1.6.5.1. Marketing Strategy

17.1.6.5.2. Product Strategy

17.1.6.5.3. Channel Strategy

17.1.7. PWT Holdings Ltd.

17.1.7.1. Overview

17.1.7.2. Product Portfolio

17.1.7.3. Profitability by Market Segments (Type /Application/Region)

17.1.7.4. Sales Footprint

17.1.7.5. Strategy Overview

17.1.7.5.1. Marketing Strategy

17.1.7.5.2. Product Strategy

17.1.7.5.3. Channel Strategy

17.1.8. Zenith Brewing Co.

17.1.8.1. Overview

17.1.8.2. Product Portfolio

17.1.8.3. Profitability by Market Segments (Type /Application/Region)

17.1.8.4. Sales Footprint

17.1.8.5. Strategy Overview

17.1.8.5.1. Marketing Strategy

17.1.8.5.2. Product Strategy

17.1.8.5.3. Channel Strategy

17.1.9. HRS Process Systems

17.1.9.1. Overview

17.1.9.2. Product Portfolio

17.1.9.3. Profitability by Market Segments (Type /Application/Region)

17.1.9.4. Sales Footprint

17.1.9.5. Strategy Overview

17.1.9.5.1. Marketing Strategy

17.1.9.5.2. Product Strategy

17.1.9.5.3. Channel Strategy

18. Assumptions & Acronyms Used

19. Research Methodology

Explore Process Automation Insights

View Reports